The Smart Strategy

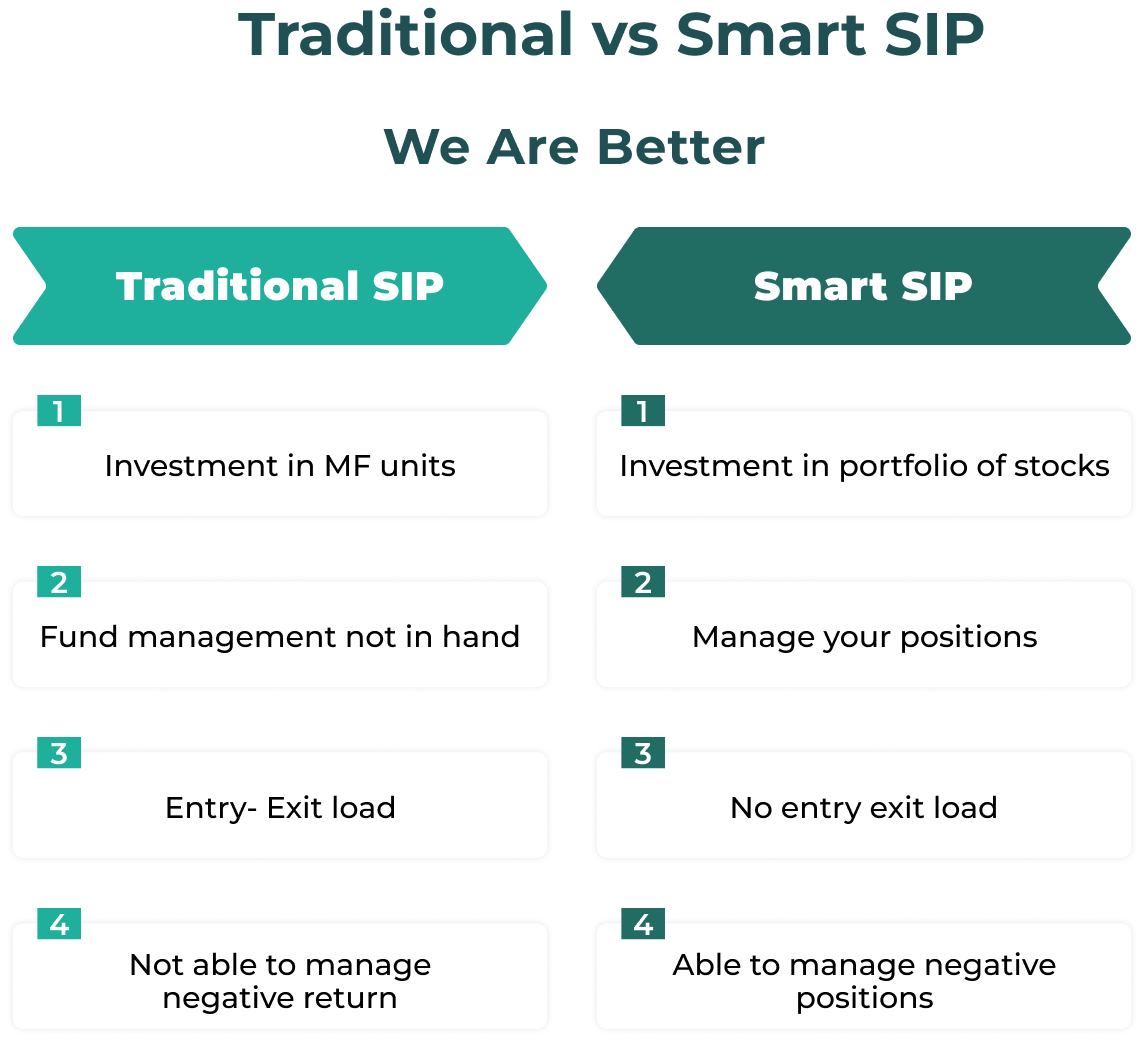

A strategy that is more effective than a mutual fund.

Swing

Momentum

Access Earning

Relative Strength

Trend Of Market

illustrations

We just don't say, We deliver it.

| Company | Entry Price | Entry Date | Gain/Loss % | Position Closed |

|---|---|---|---|---|

| AVONMORE | Rs. 14.68 | 08-Oct-24 | 20% | 15 DAYS |

| APTUS | Rs. 357 | 08-Oct-24 | 21% | 4 DAYS |

| NMDC | Rs. 215 | 08-Oct-24 | 15% | 18 DAYS |

| HDFCBANK | Rs. 1615 | 08-Oct-24 | 8% | 20 DAYS |

| NSIL | Rs. 4720 | 08-Oct-24 | 55% | 11 DAYS |

*Disclaimer: "The securities quoted are for illustration only and are not recommendatory"

*Note: The past performance is not an indicator of future performance.

Invest in Future You

Change the inputs below to see how your investment would have performed in different years compared to cash savings and how regular investing can work to your benefit.

I hadto invest starting on 1 Januaryand then contributeda month into the SMART fund until 31st Dec 2022.

*Disclaimer: "The securities quoted are for illustration only and are not recommendatory"

*Note: The past performance is not an indicator of future performance.

Designed by experts, Diversified to suit

Start your journey to match your requirements

Small Cap

Small cap companies have a price benefit than the other two categories. It is also less volatile in comparison and provides a sustainable growth in returns.

Mid Cap

Mid cap stocks are those which have a market capitalization between 5000 Cr to 20000 Cr. These are the emerging leader stocks which have a good return potential and have a capability to outperform their peers.

Large Cap

Large cap stocks are already established players in the market which are providing consistent returns along with stable growth. These stocks have a high market value and established product line widely accepted by consumers.

Have a Question ?

Our product, Smart, uses technical analysis methods such as momentum, earnings growth, relative strength, and market trends to filter stocks. This helps us to assist you in creating a stronger and more effective investment portfolio for your future.

We carefully analyze each of these factors to identify stocks that are likely to perform well and meet your investment objectives. With Smart, you can feel confident in our ability to help you make informed investment decisions based on reliable and accurate technical analysis.

Swing trading and momentum strategies are two popular technical analysis techniques that investment advisers may use to identify potential price trends and profit from them. We are here to explain these strategies and how they incorporate them into your investment approach.

Evaluating a company's access to earnings growth potential is crucial to identifying good investment opportunities. Enquire us for evaluating a company's earnings growth potential and the factors they consider, such as industry trends, financial ratios, and management track record.

Relative strength is a measure of a stock's performance compared to its peers or the overall market. We will guide you in how they use relative strength to make investment decisions and how it helps them identify potential winners in the market.

Staying informed about the latest trends and developments in technical analysis is critical to providing sound investment advice. We will help you in how they stay up-to-date with industry news and developments, including attending conferences, reading publications, and collaborating with other industry professionals.

Start investing today, for a better tomorrow

If you’d like to talk to our executive kindly call us on +91 8884014014 during 9 am - 5 pm weekdays.

Start investing today, for a better tomorrow

If you’d like to talk to our executive kindly call us on +91 8884014014 during 9 am - 5 pm weekdays.